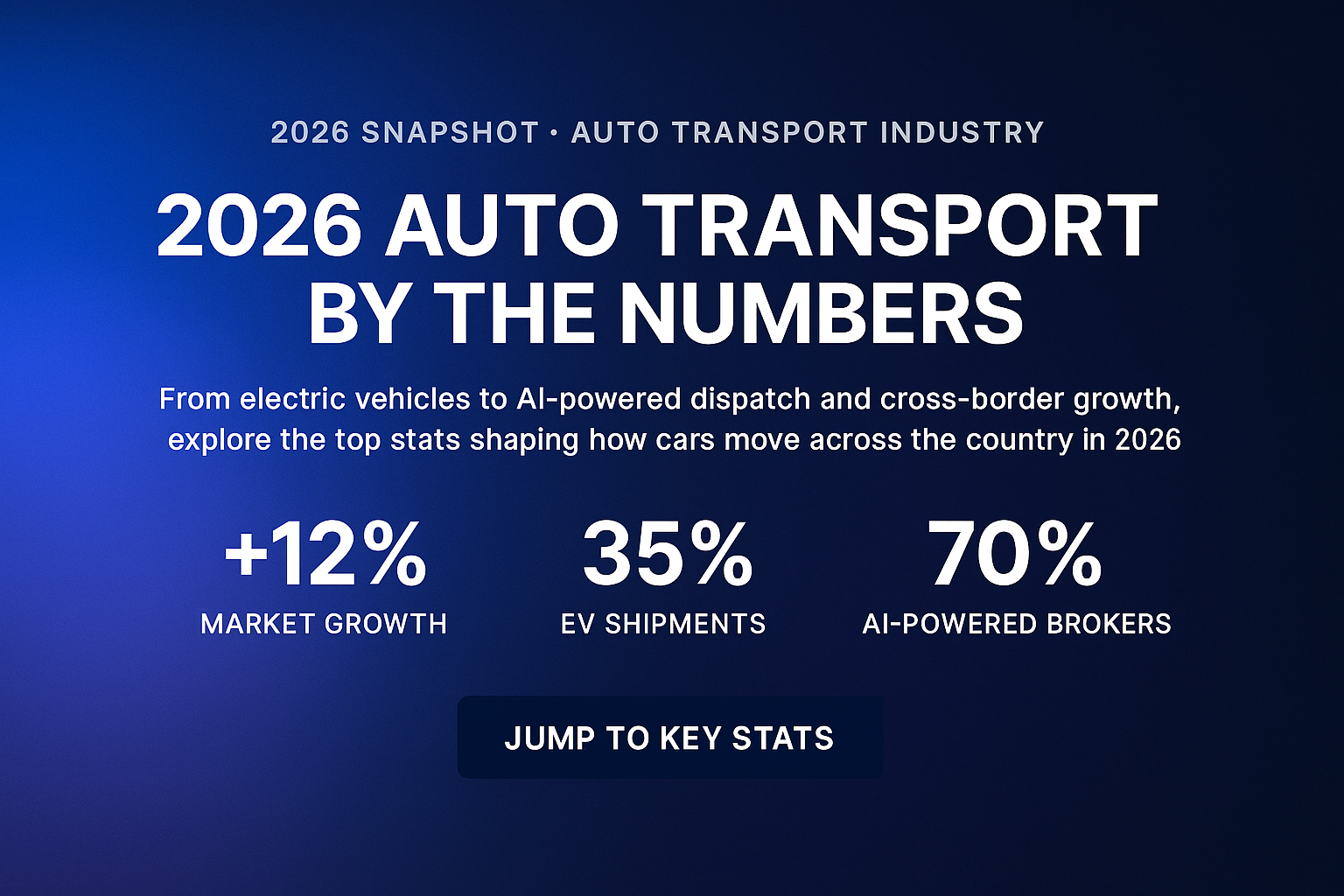

2026 Auto Transport By the Numbers: Key Stats for Shippers and Brokers

The auto transport industry is entering one of its most transformative years. From booming market growth to AI-powered operations and electric vehicles taking over transport loads, 2026 is shaping up to be a year of rapid evolution. Whether you’re a shipper, a broker, or just someone curious about how cars move around the country, these numbers paint a clear picture of what’s happening behind the scenes — and why it matters.

Let’s break down the 10 most interesting and impactful stats defining the U.S. auto transport landscape in 2026.

1. The Auto Transport Market Is Set to Grow 12%

After several turbulent years of supply chain swings and price changes, the auto transport sector is poised for a strong rebound. Industry revenue is projected to rise from $10.1B in 2025 to about $11.3B in 2026.

This growth means:

More carriers entering the market

More competition

Better availability

Faster shipping windows

A bigger market also pushes companies to improve service and pricing transparency.

2. EVs Will Represent 35% of All Shipped Vehicles

Electric vehicles are no longer rare on transport trucks. By 2026, 35% of cars shipped in the U.S. are expected to be electric. This surge is driven by consumer demand and new state-level mandates.

What this means for shippers:

Heavier vehicles = slightly higher shipping cost

EV-trained carriers become more important

More enclosed trailers used

For brokers, EV knowledge becomes a competitive edge.

3. 70% of Brokers Will Use AI for Pricing & Dispatch

AI is becoming the backbone of modern auto transport.

By 2026, 70% of brokers will rely on AI tools to generate instant quotes, automate dispatching, or manage communication.

This shift leads to:

Faster response times

More accurate quotes

Better carrier-matching

Smoother customer experiences

AI doesn’t replace brokers — it supercharges them.

4. The Busiest Route in America: California ↔ Texas

The #1 shipping lane in 2026 is the California–Texas corridor. High relocation rates between these two states keep this route consistently packed.

Other high-volume routes include:

New York ↔ Florida

Chicago ↔ Los Angeles

Seattle ↔ Phoenix

Oregon ↔ California

On these busy lanes, pricing tends to be more competitive and availability more reliable.

5. Average Shipping Costs Will Increase About 7%

Shipping a car will cost slightly more in 2026, with the average cost rising from about $1,150 to around $1,230.

Why costs are increasing:

Fuel prices

Driver shortages

Higher insurance

Equipment upgrades

Still, timing matters — winter is cheaper, summer is more expensive.

6. 80% of Shipments Will Include Real-Time GPS Tracking

In 2026, 80% of car shipments will offer GPS tracking so customers can watch their vehicle move across the map.

This reduces stress for customers and cuts call volume for brokers who previously fielded endless “Where’s my car?” questions.

7. 40% of Carriers Will Participate in Carbon Offset Programs

Sustainability is becoming a major selling point. Around 40% of carriers will use carbon-offset programs to balance emissions or operate more efficiently.

More customers — especially dealerships and corporate fleets — now prefer carriers with environmental initiatives.

8. Cross-Border Transport to Canada & Mexico Will Rise 20%

Cross-border movement of cars is growing rapidly, with a 20% increase in shipments between the U.S., Canada, and Mexico.

Mexico’s booming vehicle production and increasing U.S.-Canada trade are driving the surge.

9. Customer Satisfaction Scores Are Up 15%

Auto transport customers today are significantly happier than they were just a few years ago. The average rating has grown from 4.0★ to 4.6★, a roughly 15% jump.

Why customers are happier:

Better communication

Real-time tracking

Fewer surprise fees

More professional carriers

This is one of the best improvements in the industry.

10. Summer Shipping Volume Is 30% Higher Than Winter

Summer remains the busiest season for car shipping — with 30% more volume than winter months.

Who moves cars in summer?

Families

College students

Snowbirds returning north

Dealerships with higher summer sales

For shippers, this means:

Summer = busier + more expensive

Winter = cheaper + faster availability

Conclusion

2026 is shaping up to be a powerful year for auto transport: more EVs, more AI, more cross-border traffic, more transparency, more sustainability — and more demand.

If you’re a broker, these numbers help you stay ahead of customer expectations. If you’re a shipper, they give you a clearer picture of the landscape so you can make smarter, more confident decisions.

The industry is moving fast — and these stats show exactly where it’s headed.